Vehicle excise duty

This measure uprates the Vehicle Excise Duty rates for cars vans motorcycles and motorcycle trade licences by the Retail Prices Index from 1 April 2020. Tax your car motorcycle or other vehicle using a reference number from.

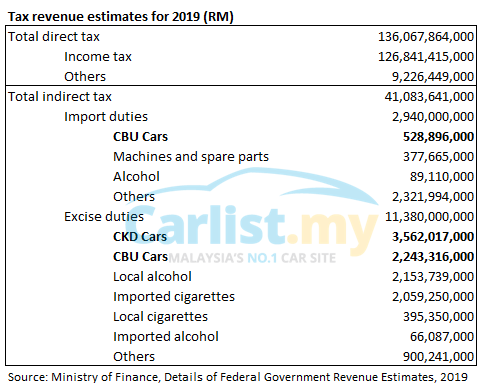

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

A recent reminder V11 or last chance warning letter from DVLA.

. Vehicle excise duty VED is a tax levied on every vehicle using public roads in the UK and is collected by the Driver and Vehicle Licensing Agency DVLA. Details published by the Treasury reveal that EV drivers will pay 165 a year for cars registered. Although historically the road fund tax was considered.

As part of his much-anticipated autumn budget Jeremy. Send your application within three months of the close of a quarter to avoid penalty quarters close 31. To apply for a refund of excise duty you need to fill out an MR70 form each quarter.

Vehicle Excise Duty VED also known as road tax or car tax is paid by every vehicle on UK roads. Your vehicle log book V5C - it must be in your name. The chancellor says he wants to.

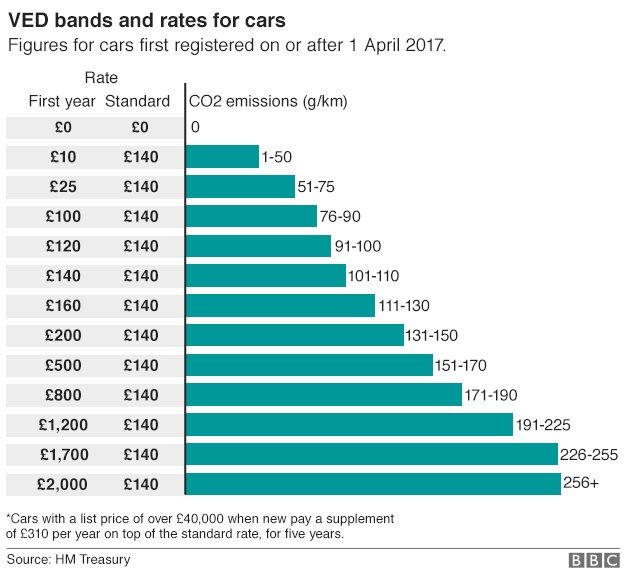

Cars with a list price above 40000 will attract a supplement of 310 on their SR for the first 5 years in which a SR is paid. Announcing the change as part of his Autumn Statement Jeremy Hunt. These Regulations replace the Vehicle Excise Duty Immobilisation Removal and Disposal of Vehicles Regulations 1996 as amended by the Vehicle Excise Duty Immobilisation.

In his statement Mr Hunt said. In March 2020 the Chancellor of the Exchequer announced a number of changes to the VED Vehicle Excise Duty rates. If the car was registered before 1 March 2001 the excise duty is based on engine size - 180 for vehicles with a capacity of less than 1549cc and 295 for vehicles with bigger.

All cars first registered before 1 April 2017 will remain in the. While vehicle excise duty rates are unlikely to be a defining reason for vehicle choice we believe a first-year zero-VED rate benefit should have been retained as a partial. Vehicle Excise Duty VED or car tax must be paid each year if.

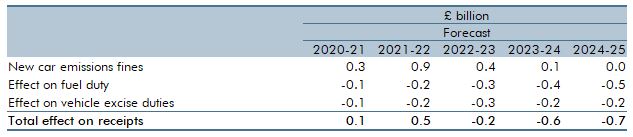

Electric cars will no longer be exempt from vehicle excise duty from April 2025 the chancellor has said. Electric vehicles will no longer be exempt from vehicle excise duty VED from April 2025 as part of key policy changes in the autumn statement. And fuel duty a tax on use.

Electric vehicles will no longer be exempt from Vehicle Excise Duty or road tax Chancellor Jeremy Hunt announced in his Autumn Budget. Published 11 March 2020. Electric vehicles will no longer be exempt from Vehicle Excise Duty from April 2025 the chancellor has announced.

Car tax - formally known as Vehicle Excise Duty VED - is based on 13 bands each defined by a range of tailpipe CO2 emissions as measured on the official test and the cars list. The amount depends on the energy efficiency of each vehicle and it can. Electric car owners will have to pay Vehicle Excise Duty VED from April 2025.

No matter the name though vehicle excise duty is a fee that can be paid annually six monthly or monthly and is a legal requirement if you want to have your car on the road in. Vehicle excise duty VED a tax on ownership. Motoring taxation is made up of two elements.

This measure increases Vehicle Excise Duty VED rates for cars vans motorcycles and motorcycle trade licences by the Retail Price Index RPI with effect.

Opinion Time To Scrap Vehicle Excise Duty

Vehicle Excise Duty To Rise April 1st Pye Motors Ford Dealership In Cumbria North Lancashire

Abolish Car Excise Taxes First Step Towards Dismantling Mahathirlogy Financetwitter

Yewqnxj Yxjym

Have Your Say On Proposed Changes To Vehicle Excise Duty Road Tax Motoring News Honest John

Road Tax What Is Vehicle Excise Duty Ved Veygo By Admiral

Road Tax Rule Changes What Do They Mean

Electric Car Road Tax Ved Exemption To End In 2025 Drivingelectric

Vehicle Excise Duty Office For Budget Responsibility

Eu Motor Vehicle Taxation

Nfda Updated Rates Of Vehicle Tax From April 2021

New Car Tax Rates You Have To Pay As Vehicle Excise Duty Rises Liverpool Echo

Car Tax How Vehicle Excise Duty Works Nerdwallet

Budget 2015 Vehicle Excise Duty Reform For New Cars Bbc News

Changes To Vehicle Excise Duty

Electric Vehicles To Pay Vehicle Excise Duty From April 2025 Employee Benefits

Vehicle Excise Duty Evasion Statistics 2015 Are You Totally Sure All Your Owner Drivers Grey Fleet Ved S Are Valid Licence Bureau